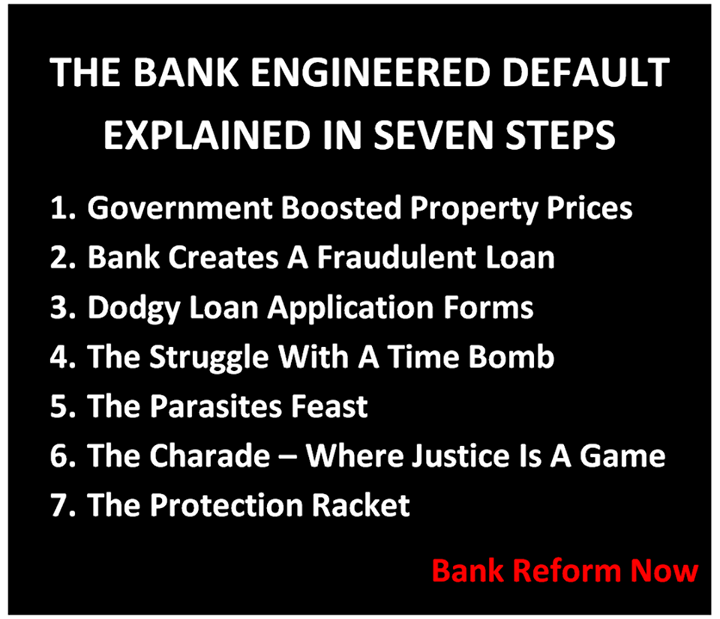

- REVEALED - The Seven Steps To A Bank Engineered Default

- FB - Bank Reform Now

- 22/07/2016 Make a Comment

- Contributed by: Jaws ( 1 article in 2016 )

It is important to realise that the engineered default or constructive default does not begin and end with fudged bank valuations at the time of purchase. Sure higher values at the origination of the loan enable larger loans - but to really understand the full picture it is necessary to look at multiple influences on the property market and banker activities. All of which affect the degree of financial stress borrowers face. In addition - the engineered default can only proceed with significant assistance from politicians, bank lawyers, liquidators, Courts and Judges.

The following step by step analysis show how the racket works. It enriches financial institutions and governments but increases the likelihood of a default from the extremely well milked borrower. The property market is a very good example of how the interaction between big business and big government harms our society and our people. Everyone’s standard of living is far lower and harder to maintain because of this.

House values and prices are directly elevated by government policy. GST, Stamp Duty and other government generated imposts have been shown to increase the cost of buying a home significantly. Also, governments control the release of land for housing. Limiting supply leads to increased prices. Both these factors increase the amount that needs to be borrowed from financial institutions.

The Property Council has shown that property owners have become Australia's largest collective taxpayer contributing 9 per cent of total tax revenue. Property taxes make up as much as 46 per cent of state, territory and local government budgets. [ https://www.smh.com.au/federal-politics/political-news/scrap-stamp-duty-and-increase-gst-says-property-council-of-australia-20150614-ghnko7 ]

On top of this bankers are more than happy to have dubious valuations inflate a property's value prior to purchase and thus manipulate the Loan to Value Ratio. Once again this allows a further increase in the amount that can be made available to the borrower.

So the above inflated cost of property requires the purchaser to borrow more money from a financial institution. Let's also remember that for some inexplicable reason Governments have given private bankers the power to create credit (the history of this makes interesting reading but it is beyond the scope of this document and inquiry).

The money that a "borrower" obtains does not exist until a promissory note is signed and given to the bank. This is a deliberate misrepresentation of a contractual obligation. Thus the bank is actually handing a further representation of the obligors own promissory obligation back to them and then pretending it is they the bank who is giving up commensurable value in any purported loan. Even worse, the bank then charges interest on this "loan."

If you think about this for just a very short time you will quickly understand why the world's finance system is the corrupt, unsustainable, immoral mess that it is. You will also understand how it is that banking is so profitable and why the wealth of the middle class is being siphoned to the upper echelon money manipulators. I would strongly argue that this indeed is a crime against humanity - particularly when you factor in that governments also borrow and then tax citizens to pay interest.

Bank loan officers earn bonuses and promotions by increasing the bank's loan book. Thus there is an incentive to lend as much money as possible to as many clients as possible. There is then a perverse incentive to engineer the Loan Application Form so that the client appears to have a higher income, more assets and fewer liabilities. Figures are routinely fudged to manipulate an LVR to less than 80%. By doing this clients are pushed into a position where the risk of default is much higher.

So now we have a client who has purchased an overpriced property with money that was created through a contractual deception. The "borrower" is paying interest on this "loan" and finds that because of a fudged Loan Application process his or her disposable income is not enough to comfortably look after the family's needs. The kids miss out on treats and then essentials. There is continuous worry about the finances. Holidays are few and far between. The bank has managed to get about as much as possible of your income. Relationship stresses build. Life isn't quite so enjoyable - it has become a struggle.

The bankers involved knew from the start that this would happen. They also knew that this was unsustainable and that around the five year mark .... boom .... the time bomb goes off and the mess likely ends in a default with the bank seizing the client’s assets. Does the bank or banker care? No - because all commissions, bonuses, interest payments, penalty fees, shareholder dividends have been collected and distributed.

We have seen cases where if the above is not enough to extract as much as possible from a client, with or without a default, bankers have been known to set up a complex web of hidden accounts. Client funds are secretly siphoned away (stolen?) and shifted at the bank's discretion to accounts without the client's knowledge. This inevitably leads to business cash flow problems. Once the bank documents the difficulties the client is now experiencing the next phase is triggered. Penalty interest rates and fees; fresh property valuations are ordered by the bank .... and this time they show significant, often inexplicable, reductions. The LVR is now way over 100%. The bank can demand payment in an unreasonable manner. Don't forget some clients in this situation have still not missed a payment. Regardless, at this stage - valuers, lawyers, liquidators are called in - all at the client’s expense - so you can imagine how fees are inflated. It becomes a feeding frenzy.

Once it progresses to liquidation the main aim is for the liquidators to maximise their returns. Getting the best possible return on assets sold to minimise the client's obligations to the bank are not the top priority. Often insiders with connections to lawyers, liquidators or bankers can pick up properties and businesses at bargain prices. This process explains how a bank victim can end up with absolutely nothing after their assets are sold from under them. See the Biritz, Troiani and Andrews stories (Cases 1, 2 & 4) to see the horror and treachery inflicted by NAB where incredibly hard working families lost everything in exactly this manner.

Some bank victims know that they were deliberately set up. The injustice burns deep. You work all your life building a successful business - providing real goods and services of real value. Then you see the parasite class who produce nothing of real value come in to take it all away by fraud, forgery and force. The victim may have the idea that the crime is so clear, so obvious, and so blatant that they could go to Court and easily find justice against the crooked bankers.

Unfortunately there has been, up until recently, a hidden truth. The bankers own the Courts - literally and figuratively. We have documented cases where Judges have resided in rooms owned by banks. Cases involving Judges who made sure they sat on disputes involving their own bank. Even cases where Judges owned large shareholdings of the bank involved.

It is very important to also understand that many bank victims lose their assets and never actually realise that they were set up and deliberately taken down with predatory maladministered loans. They blame themselves. They don't want to talk about it. They are embarrassed and think they have failed their family. How do these people get justice when governments and politicians ignore their distress and turn a blind eye to bank crimes and corruption?

What hope does a victim have with no resources as a direct consequence of a bank’s predatory actions? Because our legal system has become monetarised - by taking the assets - the bank also takes the defendant's right to a fair hearing and fair trial. Bank victim Michael Sanderson (Case 7) is fighting as a self-litigant in the Brisbane District Court to level the playing field. He is asking the Court to make orders consistent with the principle of "Equality of Arms," which the Australian Attorney General’s Department says must be observed to ensure equality. He is not just asking the court for minimal legal assistance resulting in crucifixion, rather legal assistance that is equivalent and equal. He makes a very good argument, that in the case where the plaintiff (the aggressor) has a disproportionate advantage the plaintiff should underwrite the defendant's costs.

You will have noticed that the above six steps are overflowing with bad behaviour – much of it already illegal. What may not be illegal is immoral, unethical and just plain mean, nasty and despicable – to put it mildly. Of course none of these crimes should be allowed to happen. Perpetrators should be severely punished and victims should be compensated. Why does our “Justice” system appear to be malfunctioning?

The financial institutions that profit from a non-functioning legal system are paying protection money to both the main political parties in Australia.

It really appears that politicians are not looking after the interests of citizens as far as finance system crimes are concerned – in large part - due to a conflict of interest involving party funding.

Another aspect of the protection racket is the inaction of the police, regulators and Courts. They appear very reluctant to investigate fraud, forgery and other bank crimes. Victims are routinely given the run around - with each player just referring them away to another of the players. Regulator terms of reference are rigged to protect the bankers. This game must be stopped.

It really is crunch time for politicians and regulators. They can be on the right side of history and become heroes in the fight for justice and reform. Alternatively they can side with criminals and face the consequences.

Just to make it clear to those politicians sitting on this inquiry – more and more of us understand how the racket works. We are all being fleeced while you and your colleagues sit on more and more inquiries. Sorry - but you fiddling while we are burning is not helping.

Call a wide-ranging, unfettered Royal Commission into the whole box & dice: Banking; Finance; Credit Cards; Predatory Banking; Control Fraud; Credit Creation; Fraud; Forgery; Vertical Integration; Contracts; Managed Investment Schemes; Abuse of Farmers; Liquidator, Valuer and Judicial irregularities; Commission, Bonus and Promotion Systems. THE WORKS..!

It is long overdue. I hate to break it to you - but there is a reason, after a lifetime of work, so many of our older Australians are dependent on the government's pathetic aged pension. They have been screwed their whole working life by a corrupt banking and finance system ….... aided and abetted by successive governments colluding against the peoples' interests. The people are waking up to the truth. It is a hard truth …… our elected representatives have deliberately allowed criminals to profit at the peoples’ expense.

Thank you for your time,

Yours faithfully,

Dr Peter Brandson

___________________

CEO Bank Reform Now

___________________

The above post is an excerpt from the Bank Reform Now Submission to the Parliamentary Joint Committee on Corporations and Financial Services regarding: The Impairment of Customer Loans (aka as Bank Engineered Defaults).

Dr Brandson felt it was important to provide a simple, easily understood explanation of the default process. It can be clearly seen how these bank activities reduce the standard of living of every person in the country. It can also be clearly seen how this racket enriches the manipulators of money and their collaborators, cronies & accomplices.

You can download a CENSORED pdf version of the Submission at - https://www.aph.gov.au/DocumentStore.ashx?id=da644d63-2a43-4860-8e5f-91363b7d81c7&subId=405358 - In addition to the Seven Step process explanation you will also find seven case studies of horrific bank engineered defaults - six involving the National Australia Bank. However don't download it yet - we expect the uncensored version to be put up very soon.

The complete submission named names. We were told by the committee that if those named were given a right of reply then the complete document would be uploaded. So far we are not satisfied with what looks like a cover-up and protection of people involved in predatory and unconscionable banking. The head of this committee is Senator David Fawcett. Maybe we should contact our Prime Minister Mr Turnbull (ex-Goldman Sachs Banker) and get him to look into how pollies appear unwilling to investigate banker crimes and corruption - Contact him here - https://www.pm.gov.au/contact-your-pm

BRN will be asking for your help soon. Help us end the protection racket. Help us bring about real reforms. Join in - Spread the word and we'll keep working to help give you an open, honest and fair banking system. One which serves your interests. Are you interested in seeing the crooked bankers jailed after their ill-gotten profits are clawed back? We are.

Exposed - the 7 Step DefaultExposed - the 7 Step Default

The following step by step analysis show how the racket works. It enriches financial institutions and governments but increases the likelihood of a default from the extremely well milked borrower. The property market is a very good example of how the interaction between big business and big government harms our society and our people. Everyone’s standard of living is far lower and harder to maintain because of this.

Step 1 - The Elevation of Property Value at Time of Purchase

House values and prices are directly elevated by government policy. GST, Stamp Duty and other government generated imposts have been shown to increase the cost of buying a home significantly. Also, governments control the release of land for housing. Limiting supply leads to increased prices. Both these factors increase the amount that needs to be borrowed from financial institutions.

The Property Council has shown that property owners have become Australia's largest collective taxpayer contributing 9 per cent of total tax revenue. Property taxes make up as much as 46 per cent of state, territory and local government budgets. [ https://www.smh.com.au/federal-politics/political-news/scrap-stamp-duty-and-increase-gst-says-property-council-of-australia-20150614-ghnko7 ]

On top of this bankers are more than happy to have dubious valuations inflate a property's value prior to purchase and thus manipulate the Loan to Value Ratio. Once again this allows a further increase in the amount that can be made available to the borrower.

Step 2 - The Creation of the Loan

So the above inflated cost of property requires the purchaser to borrow more money from a financial institution. Let's also remember that for some inexplicable reason Governments have given private bankers the power to create credit (the history of this makes interesting reading but it is beyond the scope of this document and inquiry).

The money that a "borrower" obtains does not exist until a promissory note is signed and given to the bank. This is a deliberate misrepresentation of a contractual obligation. Thus the bank is actually handing a further representation of the obligors own promissory obligation back to them and then pretending it is they the bank who is giving up commensurable value in any purported loan. Even worse, the bank then charges interest on this "loan."

If you think about this for just a very short time you will quickly understand why the world's finance system is the corrupt, unsustainable, immoral mess that it is. You will also understand how it is that banking is so profitable and why the wealth of the middle class is being siphoned to the upper echelon money manipulators. I would strongly argue that this indeed is a crime against humanity - particularly when you factor in that governments also borrow and then tax citizens to pay interest.

Step 3 - The Loan Application Form

Bank loan officers earn bonuses and promotions by increasing the bank's loan book. Thus there is an incentive to lend as much money as possible to as many clients as possible. There is then a perverse incentive to engineer the Loan Application Form so that the client appears to have a higher income, more assets and fewer liabilities. Figures are routinely fudged to manipulate an LVR to less than 80%. By doing this clients are pushed into a position where the risk of default is much higher.

Step 4 - The Struggle With A Time Bomb

So now we have a client who has purchased an overpriced property with money that was created through a contractual deception. The "borrower" is paying interest on this "loan" and finds that because of a fudged Loan Application process his or her disposable income is not enough to comfortably look after the family's needs. The kids miss out on treats and then essentials. There is continuous worry about the finances. Holidays are few and far between. The bank has managed to get about as much as possible of your income. Relationship stresses build. Life isn't quite so enjoyable - it has become a struggle.

The bankers involved knew from the start that this would happen. They also knew that this was unsustainable and that around the five year mark .... boom .... the time bomb goes off and the mess likely ends in a default with the bank seizing the client’s assets. Does the bank or banker care? No - because all commissions, bonuses, interest payments, penalty fees, shareholder dividends have been collected and distributed.

Step 5 - The Parasites Feast

We have seen cases where if the above is not enough to extract as much as possible from a client, with or without a default, bankers have been known to set up a complex web of hidden accounts. Client funds are secretly siphoned away (stolen?) and shifted at the bank's discretion to accounts without the client's knowledge. This inevitably leads to business cash flow problems. Once the bank documents the difficulties the client is now experiencing the next phase is triggered. Penalty interest rates and fees; fresh property valuations are ordered by the bank .... and this time they show significant, often inexplicable, reductions. The LVR is now way over 100%. The bank can demand payment in an unreasonable manner. Don't forget some clients in this situation have still not missed a payment. Regardless, at this stage - valuers, lawyers, liquidators are called in - all at the client’s expense - so you can imagine how fees are inflated. It becomes a feeding frenzy.

Once it progresses to liquidation the main aim is for the liquidators to maximise their returns. Getting the best possible return on assets sold to minimise the client's obligations to the bank are not the top priority. Often insiders with connections to lawyers, liquidators or bankers can pick up properties and businesses at bargain prices. This process explains how a bank victim can end up with absolutely nothing after their assets are sold from under them. See the Biritz, Troiani and Andrews stories (Cases 1, 2 & 4) to see the horror and treachery inflicted by NAB where incredibly hard working families lost everything in exactly this manner.

Step 6 - The Charade - Where Justice Is A Game

Some bank victims know that they were deliberately set up. The injustice burns deep. You work all your life building a successful business - providing real goods and services of real value. Then you see the parasite class who produce nothing of real value come in to take it all away by fraud, forgery and force. The victim may have the idea that the crime is so clear, so obvious, and so blatant that they could go to Court and easily find justice against the crooked bankers.

Unfortunately there has been, up until recently, a hidden truth. The bankers own the Courts - literally and figuratively. We have documented cases where Judges have resided in rooms owned by banks. Cases involving Judges who made sure they sat on disputes involving their own bank. Even cases where Judges owned large shareholdings of the bank involved.

It is very important to also understand that many bank victims lose their assets and never actually realise that they were set up and deliberately taken down with predatory maladministered loans. They blame themselves. They don't want to talk about it. They are embarrassed and think they have failed their family. How do these people get justice when governments and politicians ignore their distress and turn a blind eye to bank crimes and corruption?

What hope does a victim have with no resources as a direct consequence of a bank’s predatory actions? Because our legal system has become monetarised - by taking the assets - the bank also takes the defendant's right to a fair hearing and fair trial. Bank victim Michael Sanderson (Case 7) is fighting as a self-litigant in the Brisbane District Court to level the playing field. He is asking the Court to make orders consistent with the principle of "Equality of Arms," which the Australian Attorney General’s Department says must be observed to ensure equality. He is not just asking the court for minimal legal assistance resulting in crucifixion, rather legal assistance that is equivalent and equal. He makes a very good argument, that in the case where the plaintiff (the aggressor) has a disproportionate advantage the plaintiff should underwrite the defendant's costs.

Step 7 - The Protection Racket (aka Insurance Policy)

You will have noticed that the above six steps are overflowing with bad behaviour – much of it already illegal. What may not be illegal is immoral, unethical and just plain mean, nasty and despicable – to put it mildly. Of course none of these crimes should be allowed to happen. Perpetrators should be severely punished and victims should be compensated. Why does our “Justice” system appear to be malfunctioning?

The financial institutions that profit from a non-functioning legal system are paying protection money to both the main political parties in Australia.

It really appears that politicians are not looking after the interests of citizens as far as finance system crimes are concerned – in large part - due to a conflict of interest involving party funding.

Another aspect of the protection racket is the inaction of the police, regulators and Courts. They appear very reluctant to investigate fraud, forgery and other bank crimes. Victims are routinely given the run around - with each player just referring them away to another of the players. Regulator terms of reference are rigged to protect the bankers. This game must be stopped.

It really is crunch time for politicians and regulators. They can be on the right side of history and become heroes in the fight for justice and reform. Alternatively they can side with criminals and face the consequences.

Just to make it clear to those politicians sitting on this inquiry – more and more of us understand how the racket works. We are all being fleeced while you and your colleagues sit on more and more inquiries. Sorry - but you fiddling while we are burning is not helping.

Call a wide-ranging, unfettered Royal Commission into the whole box & dice: Banking; Finance; Credit Cards; Predatory Banking; Control Fraud; Credit Creation; Fraud; Forgery; Vertical Integration; Contracts; Managed Investment Schemes; Abuse of Farmers; Liquidator, Valuer and Judicial irregularities; Commission, Bonus and Promotion Systems. THE WORKS..!

It is long overdue. I hate to break it to you - but there is a reason, after a lifetime of work, so many of our older Australians are dependent on the government's pathetic aged pension. They have been screwed their whole working life by a corrupt banking and finance system ….... aided and abetted by successive governments colluding against the peoples' interests. The people are waking up to the truth. It is a hard truth …… our elected representatives have deliberately allowed criminals to profit at the peoples’ expense.

Thank you for your time,

Yours faithfully,

Dr Peter Brandson

___________________

CEO Bank Reform Now

___________________

The above post is an excerpt from the Bank Reform Now Submission to the Parliamentary Joint Committee on Corporations and Financial Services regarding: The Impairment of Customer Loans (aka as Bank Engineered Defaults).

Dr Brandson felt it was important to provide a simple, easily understood explanation of the default process. It can be clearly seen how these bank activities reduce the standard of living of every person in the country. It can also be clearly seen how this racket enriches the manipulators of money and their collaborators, cronies & accomplices.

You can download a CENSORED pdf version of the Submission at - https://www.aph.gov.au/DocumentStore.ashx?id=da644d63-2a43-4860-8e5f-91363b7d81c7&subId=405358 - In addition to the Seven Step process explanation you will also find seven case studies of horrific bank engineered defaults - six involving the National Australia Bank. However don't download it yet - we expect the uncensored version to be put up very soon.

The complete submission named names. We were told by the committee that if those named were given a right of reply then the complete document would be uploaded. So far we are not satisfied with what looks like a cover-up and protection of people involved in predatory and unconscionable banking. The head of this committee is Senator David Fawcett. Maybe we should contact our Prime Minister Mr Turnbull (ex-Goldman Sachs Banker) and get him to look into how pollies appear unwilling to investigate banker crimes and corruption - Contact him here - https://www.pm.gov.au/contact-your-pm

BRN will be asking for your help soon. Help us end the protection racket. Help us bring about real reforms. Join in - Spread the word and we'll keep working to help give you an open, honest and fair banking system. One which serves your interests. Are you interested in seeing the crooked bankers jailed after their ill-gotten profits are clawed back? We are.

Exposed - the 7 Step DefaultExposed - the 7 Step Default

1Will not be visible to public.

2Receive notification of other comments posted for this article. To cease notification after having posted click here.

3To make a link clickable in the comments box enclose in link tags - ie.<link>Link</link>.

4To show an image enclose the image URL in tags - ie.<image>https://fredspage.com/box.jpg</image>. Note: image may be resized if too large

To further have your say, head to our forum Click Here

To contribute a news article Click Here

To view or contribute a Quote Click Here